michigan sales tax exemption nonprofit

The following exemptions DO NOT require the purchaser to provide a number. We never bill hourly unlike brick-and-mortar CPAs.

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Sales or rentals to qualified non-profit health welfare education charitable and benevolent institutions religious organizations and hospitals are not subject to sales and use tax.

. Organizations exempted by statute. Community Consulting Associates specialized in helping nonprofit organizations with government reporting and tax requirements research and writing projects financial management media. Once your organization receives your 501c determination letter from the IRS it will automatically be.

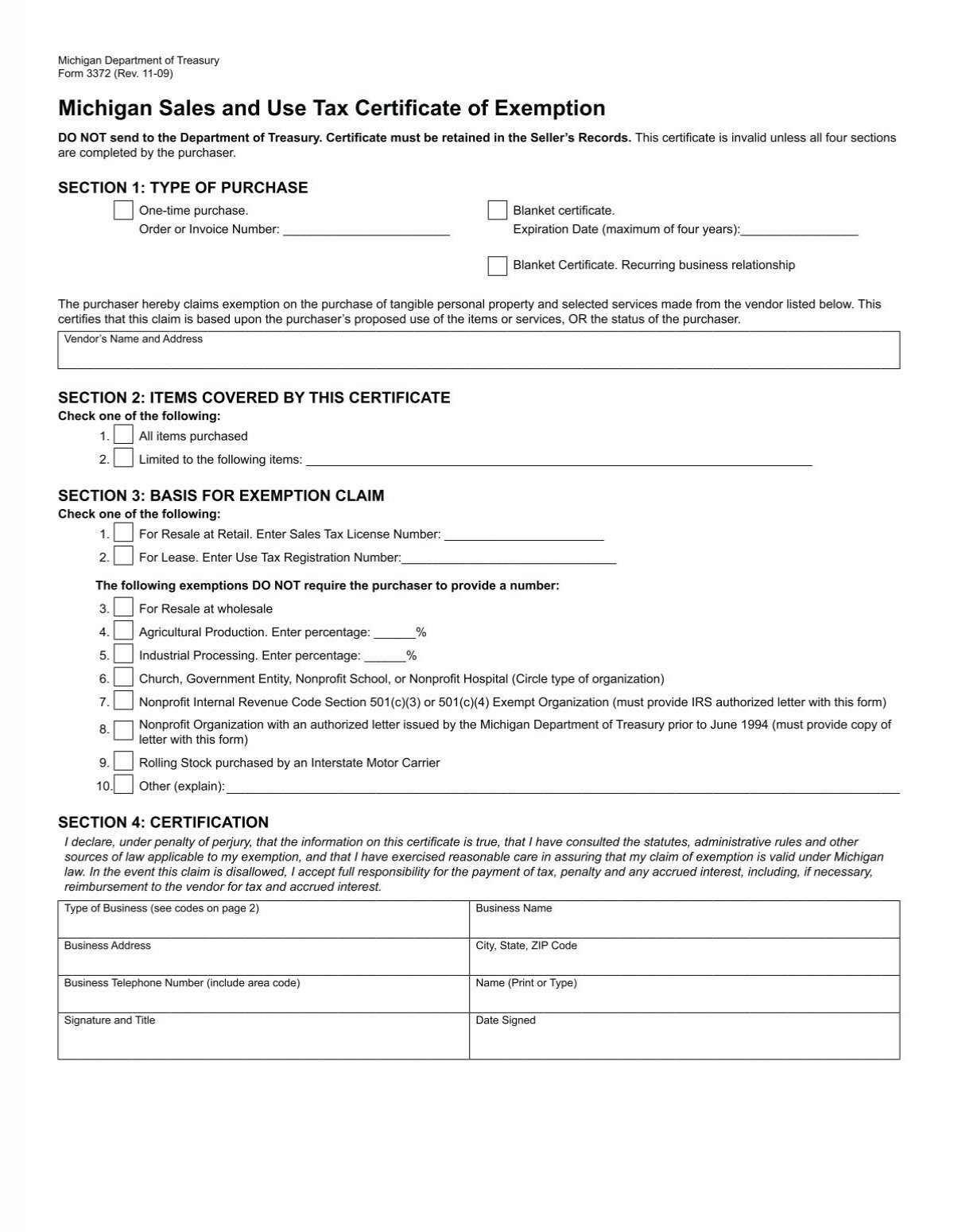

Due to a change in the law regarding nonprofit organizations the Department of Treasury no longer has an application for exemption process. Nonprofit Organizations with an Exempt letter from the State of. Michigan Department of Treasury Form 3372 Rev.

This includes any corporation community chest fund foundation or association that is organized and. The General Sales Tax Act requires a taxpayer eg aretail seller to collect the sales tax on transfers of tangible property andremit the tax to the state. When completing a sales tax exemption certificate a nonprofit should be certain to complete the form in full and avoid an simple mistakes that may delay processing.

The following exemptions DO NOT require the purchaser to provide a number. Form 3372 Michigan Sales and Use Tax Certificate of Exemption Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits Fund Raisers - Licensing. Michigan Sales Tax Exemption for a Nonprofit Michigan automatically exempts eligible charities from sales tax so there is no need to apply for an exemption.

Enjoy flat rates with no-surprises. Enter Sales Tax License Number. Nonprofit organizations in Michigan are tax-exempt year-round for natural gas use.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Church Government Entity Nonprofit School or. The following exemptions DO NOT require the purchaser to provide a number.

01-21 Michigan Sales and Use Tax Certificate of Exemption. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on. Church Government Entity Nonprofit School or.

D Church Government Entity Nonprofit. Nonprofit Internal Revenue Code Section 501c3 and 501c4 Exempt Organizations Attach copy of IRS letter ruling. Many kindsof transactions are.

Common Sales and Use Tax Exemptions and Requirements. 501 c 3 and 501 c 4 Organizations 501 c 3 and 501 c 4 organizations must provide proof that they are. Certificate must be retained in the.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Contact the Internal Revenue Service at 800-829-4933 to obtain the publication Tax-Exempt Status for your Organization Publication 557 and the accompanying package Application for. Michigan Department of Treasury 3372 Rev.

State income tax exemption. We never bill hourly unlike brick-and-mortar CPAs. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to.

Charities may however need to. You will have to provide proof that your organization is Michigan non-profit. Apply for exemption from state taxes.

11-09 Michigan Sales and Use Tax Certificate of Exemption DO NOT send to the Department of Treasury. Enjoy flat rates with no-surprises. This exemption claim should be completed by the purchaser provided to the seller.

The following exemptions DO NOT require the purchaser to provide a number.

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Mi Sales Tax Exemption Form Animart

Michigan Sales And Use Tax Certificate Of Exemption

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller